Sales price variance measures the difference between the actual selling price of a product and the budgeted or expected selling price. This variance helps businesses understand how pricing strategies and market conditions have impacted their revenue. By analyzing sales price variance, companies can identify whether they are achieving their pricing objectives and assess the effectiveness of their pricing strategies. By examining these variances separately, businesses can gain a deeper understanding of their sales performance and make more informed strategic decisions.

Recommended Books, Articles, and Online Courses on Variance Analysis

- The selling quantity will increase if we decrease the price and vice versa.

- As can be seen, a selling price variance is more than just about the selling price.

- Technological advances can create new opportunities for increasing sales volume.

- On the other hand, a selling price variance establishes a change in revenue due to a difference in expected and actual selling prices.

- This positive variance of $6,000 indicates that the company was able to sell its product at a higher price than expected, resulting in additional revenue.

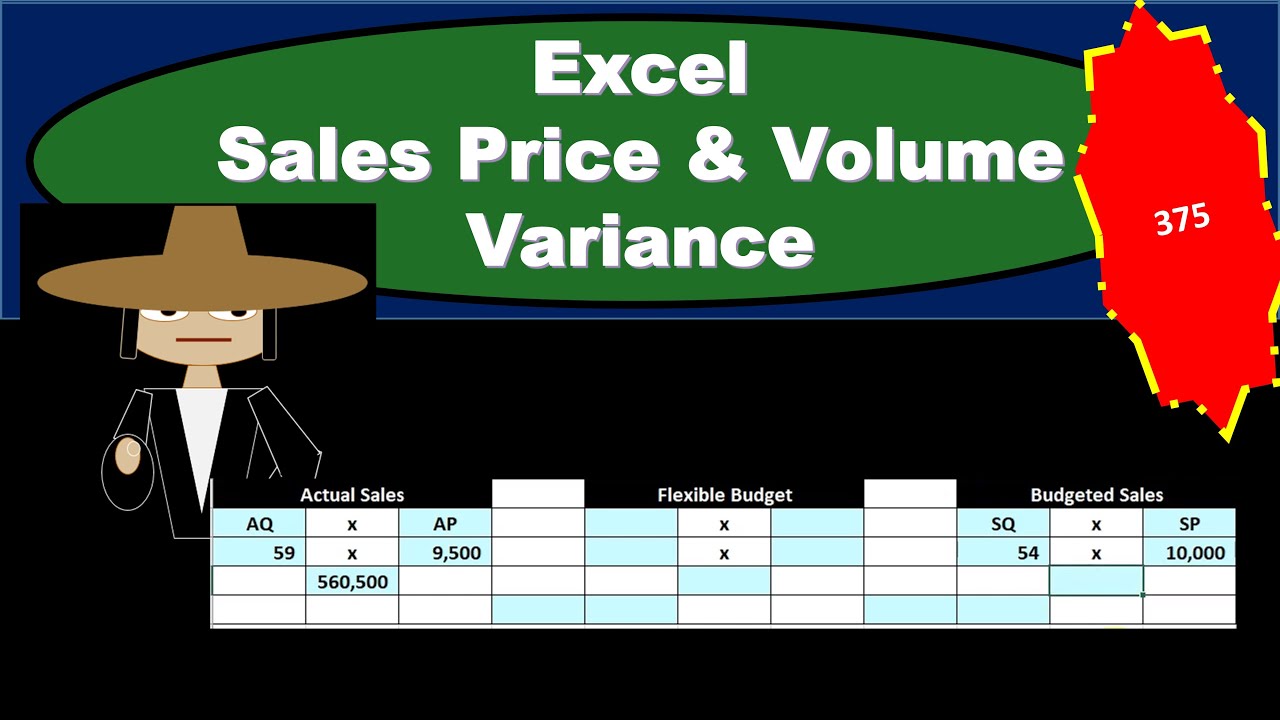

It allows for customized calculations, data visualization, and the creation of detailed reports. Excel’s pivot tables, charts, and formulas are particularly useful for analyzing sales volume and sales price variances. Promotional activities such as discounts, special offers, and loyalty programs can temporarily lower the selling price to boost sales. While these activities can increase volume, they often result in a negative sales price variance as the actual selling price during the promotion period is lower than the budgeted price. Market conditions play a significant role in determining the actual selling price.

Components of Sales Volume Variance

Customer perception of the value of a product or service can influence the selling price. If customers perceive a product as high-quality or offering superior value, they may be willing to pay a higher price. Conversely, if the product is perceived as less valuable or inferior, the company might need to lower the price to attract buyers. This negative variance of $8,000 indicates that the company sold its product at a lower price than expected, leading to a shortfall in revenue.

Sales Mix: How to Calculate It For Increased Profits

Moreover, it helps companies make appropriate decisions while deciding the number of items to order from the supplier. It could be used for both revenue and cost so a firm can evaluate and manage its revenue plus price in a better manner. Hence, this concept is used in cost accounting and financial management to assess the impact of cost fluctuations on a company’s financial performance. The standard selling price is the price that management has estimated during the production process. It is the basic which help to support their decision in producing units and profitability.

= (2018 Units sold @ 2017 Mix – 2017 Units Sold) x 2017 Profit Margin per unit

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. The following details are given about a company selling a model of their car for two years.

Profit Method

Understanding the root causes behind sales performance variations enables better planning and execution of business strategies. Technological advancements can lead to changes in production processes and cost structures, impacting pricing. Innovations that reduce production costs might enable businesses to lower their selling prices, while new technologies that enhance product features could justify higher prices. As can be seen the sales value variance is equal to the sum of the sales volume variance and the sales price variance.

regressive vs proportional vs progressive taxes is adverse when the actual selling price isless than the standard selling price. Price variance concerns the difference between standard profit and actual profit. This type of variance is the same as price variance in the turnover technique. A favorable variance occurs due to a more-than-expected customer’s acceptance of the product, fewer competitors, and a successful marketing campaign. When the demand for the product is initially high, businesses increase the price.

The chain adjusted its pricing strategy to capitalize on these insights, leading to increased revenue from premium locations while maintaining competitive rates in less popular areas. The formula for calculating sales price variance involves multiplying the difference between the actual selling price and the budgeted selling price by the actual number of units sold. A sales price variance analysis provides many insights to the company’s management. Based on the direction of the variance, they can increase the selling price of products and services. They can also decide to discontinue a product if they are not yielding expected returns.

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. In conclusion, they have earned more than the expected, standardrevenue which they decided before selling the items. It helps them plan whether to provide discounts or to raise the prices of the product.