This positive variance of $6,000 indicates that the company was able to sell its product at a higher price than expected, resulting in additional revenue. This negative variance of $1,250 shows that the company fell short of its sales target, resulting in lower than expected profits. This positive variance of $2,000 indicates that the company sold more units than expected, resulting in higher profits.

How to Calculate Sales Price Variance? The formula, Example, And Analysis

Although this scenario can be disappointing, it is a reality of doing business, especially for those companies in competitive markets. Richard started his career in Jerusalem, planning new towns for the State of Israel. He served as the Planning Director of the Manhattan Borough President’s Office (Ruth Messinger), the City of Jersey City, and the City of Coral Gables. Richard effectively represented 26 properties impacted by Phase I of the 2nd Avenue Subway Project by providing technical and political assistance and was involved with the #7 Train Expansion. He serves as an expert witness for eminent domain compensation trials involved with Hudson Yards, Atlantic Yards, and the Columbia University expansion.

- An unfavorable variance occurs due to a decrease in demand, an increase in competitors, a lower price ceiling, etc.

- A sales price variance analysis provides many insights to the company’s management.

- The sales price variance can reveal which products contribute the most to total sales revenue and shed insight on other products that may need to be reduced in price.

- It follows the standard formula but ignores the ‘Number of Units Sold’ term.

Profit Method

Favorable means that the actual price is higher than budgeted so company makes more revenue than expected. We expect the price to stay the same or slightly different from the standard price. The effectiveness and cost of distribution channels can also affect the actual selling price. Efficient distribution networks that reduce costs can allow businesses to offer competitive prices, while expensive or inefficient distribution methods might necessitate higher prices to cover additional costs. Technological advances can create new opportunities for increasing sales volume.

Misinterpreting Data

While variance analysis is an essential tool for financial and sales performance evaluation, it is important to be aware of its limitations and potential pitfalls. During peak seasons, such as holidays or special events, demand for certain products may increase, allowing businesses to charge higher prices. In off-peak periods, companies might lower prices to stimulate sales, affecting the sales price variance. By regularly calculating and analyzing sales volume variance, businesses can gain valuable insights into their sales performance, identify trends, and implement strategies to improve future sales outcomes. The sales volume variance formula shows that the variance is negative and therefore an unfavorable variance. The actual volume (13,500) is less than the budgeted volume (15,000) by 1,500 units.

Moreover, the price variance is not limited to cost but can be applied to revenue or selling price. While using revenue simply means the variance in actual income and the estimated revenue. Hence, the sales price variance helps assess whether the substantial revenue generated aligns with the expected or budgeted revenue based on the standard selling price. Price variance is a measure that quantifies the difference between the actual cost of a resource and the expected or budgeted cost of that resource. The concept is primarily used in cost accounting to decide how much of an item must be purchased. However, purchase price variance analysis, along with other variance analyses, plays a crucial role in managing procurement costs, making informed decisions, and optimizing cost structures.

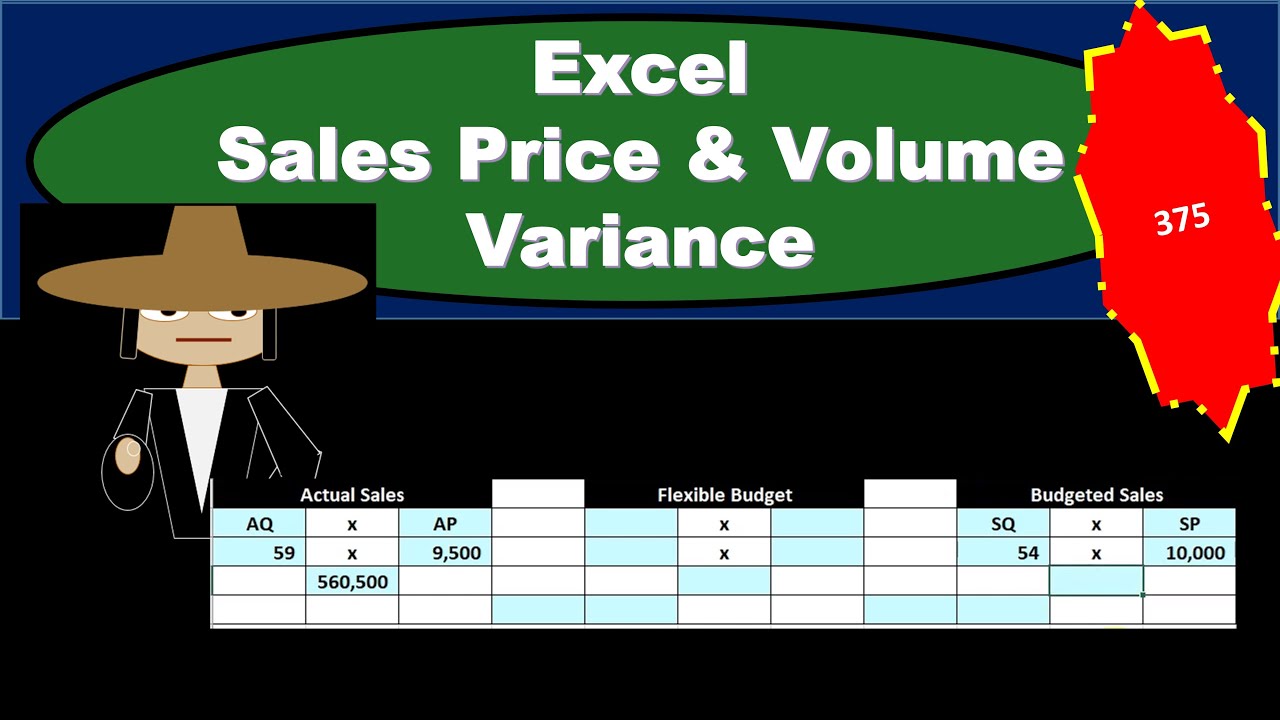

Sales Variance Formula

In this situation, the company raised the price of their product to temporarily reduce demand, and they still brought in more revenue than they originally planned. At this point, we have understood the impact of Sale price and volume on the $268 change in Profit Margin in 2018 vs 2017. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

Say you work for a company that sells potted plants online, and your company expects to sell 100 pothos plants in decorative pots for $30 each. After one month, the plants are selling above projections due to a viral TikTok review, and the demand for your product is sky-high. To allow time for your manufacturing team to restock, you raise prices to $35. Now that we understand the causes and potential outcomes of sales variance, let’s walk through how to calculate it. Sales variance can either be favorable, which is when the company receives more money from the sale of a product than expected, or unfavorable when the company receives less money from the sale of a product than expected.

The sales variance formula shows that the variance is positive and therefore a favorable variance. The actual sales (74,250) are greater than the budgeted sales (73,000) by 2,250. If actual sales are greater than budgeted sales the formula gives a positive result and therefore the sales variance is referred to as a favorable sales variance. Furthermore, a positive price variance indicates that the actual cost was lower than the standard cost, which could be due to favorable factors such as negotiating better prices with suppliers, and cost-saving initiatives. Conversely, a negative price variance suggests that the actual cost was higher than the standard cost, which might be due to factors like inflation, unexpected price increases, or inefficiencies in procurement. Besides, a purchase manager should only partially depend on variance parameters but instead go into full detail to know the actual reason for the differences in cost.

Business Intelligence (BI) tools like Tableau and Power BI offer advanced data visualization and analytics capabilities. These tools can connect to various data sources, providing interactive dashboards and reports that help businesses analyze sales variances effectively. By understanding and monitoring these factors, businesses can better manage their sales volume, adjust their strategies proactively, tax deductions for officers of a nonprofit organization and achieve their sales targets more effectively. The overall increase of $268 in Profit margin can be clearly explained with Price increase resulting in fav. Sales Mix refers to the share of each product in total Sales, in terms of percentage. If you look at the number of units sold, you will see that in 2017, 50 apples were sold which is 28% of total sales of 180 units (50/180).

Richard has also successfully represented clients impacted by blight and redevelopment plans in Newark, Hoboken, Jersey City, Hudson County, and other New Jersey locations. His practice focuses on land use, zoning, community and economic development, and political process matters on behalf of for-profit and not-for-profit clients. He has extensive experience with inclusionary housing regulations, transfer of development rights, landmarks issues, and various tax exemption programs. However, our analysis is not finished, and we need to understand the impact of Mix and Quantity.